Technical Education, Vocational and Entrepreneurship Authority

&

Chalimbana Local Government Training Institute

| Name of Learning Programme | Diploma in Local Government Finance |

| ZQF Level | 6 |

Start: January

Exams: December

Calendar–System: Term

Application Deadline: Until January

Fees: More information under “Payments“

Contact: For more information contact Mr Tembo +260 977759724

1. Rationale

With the advent of decentralization in Zambia, local authorities are expected to provide quality services to the communities and for them to effectively achieve this they need to mobilise adequate financial resources. The available resources should be managed and accounted for properly.

Currently, most accounting staff are certificate holders in Local Government Finance and even those who join with other accounting qualification are unable to perform up to expected standards as the local Government Financial system is peculiar to that obtaining in the public and private sectors.

Therefore the Diploma Course in Local Government Finance is aimed at providing knowledge skills and attitudes necessary to mobilize and manage financial resources of local authorities in an effective manner.

It is therefore against this background that a Diploma Course in Local Government Finance has been developed in order to adequately equip the local government finance staff to handle the rising challenges and at the same time help orient the other accounting staff who join local authorities with qualifications other than Local Government Finance qualification.

2. Programme Purpose

The purpose of this programme is to equip the trainee with knowledge, skills and attitudes to provide the local authorities with competent personnel to mobilize and manage funds, prepare and maintain books of accounts for efficient financial management in local authorities.

3. Programme Objectives

On completion of this programme the trainee will be able to:

1. Apply the accounting knowledge to work in the finance department.

2. Participate in financial forecasts/budgeting process for the local authorities.

3. Apply principles of business and corporate law.

4. Use computers and accounting packages.

5. Interpret economic trends in the environment.

6. Identify sources of revenue for local authorities.

7. Implement local authorities financial policies.

8. Enhance accountability of funds.

9. Comply with accounting and auditing principles.

10. Apply mathematical methods to analyse and solve problems encountered in the business environment.

11. Apply principle of the central government administration.

12. Interpret financial statements according to the accounting standards.

13. Interpret the legal implications of public sector operations.

14. Apply principles of public finance.

4. Duration

The Diploma programme will be for three (3) years with 3970 notional learning hours. Students will have institutionalized instruction time during the first five terms, and go for industrial attachment in the second term of the third year. In the last term of the third year, students will continue learning in the college.

5. Course Outline

First Year

| Course Code | Course Name | Hours |

|---|---|---|

| 253-01A | Financial Management for local Authorities | 180 |

| 253-02A | Management | 180 |

| 253-03A | Economics | 200 |

| 253-04A | Financial Accounting I | 210 |

| 253-05A | Mathematics and statistics I | 210 |

| 253-06A | Business Law | 180 |

| 253-07A | Communication Skills | 200 |

| 253-08A | Computer Application | 210 |

Second Year

| Course Code | Course Name | Hours |

|---|---|---|

| 253-09B | Auditing | 210 |

| 253-10B | Corporate Law | 200 |

| 253-11B | Mathematics and Statistics II | 210 |

| 253-12B | Central Government Administration | 180 |

| 253-13B | Financial Accounting II | 210 |

Third Year

| Course Code | Course Name | Hours |

|---|---|---|

| 253-14C | Financial Management and Management Accounting Reporting | 200 |

| 253-15C | Constitution and Administrative Law | 200 |

| 253-16C | Cost and Management Accounting | 210 |

| 253-17C | Public Finance | 200 |

| 253-18C | Enterpreneurship | 100 |

| 253-19C | Industrial Attachment ( Term Two) | 480 |

6. Teaching Strategies

Learning shall constitute lectures, projects, discussions, presentations, visual aids, field trips, assignments, case studies and practical training.

7. Minimum Entry Requirement

Direct Entry

Grade 12 school certificate with a minimum of 5 credits which must include English Language and Mathematics.

Mature Age Entry

Grade 12 level of education with at least 3 credit passes, which must include Mathematics, English and any other subject; and a Certificate in a relevant field.

Applicants with a minimum of 5 years relevant work experience in a local authority setting and a recommendation of the Head of the Institution/Department shall also be considered.

Exemptions

Applicants with a Local Government Finance Certificate will enter the programme in the second year and those with Advanced Certificate in Local Government Finance will enter at third year where applicable.

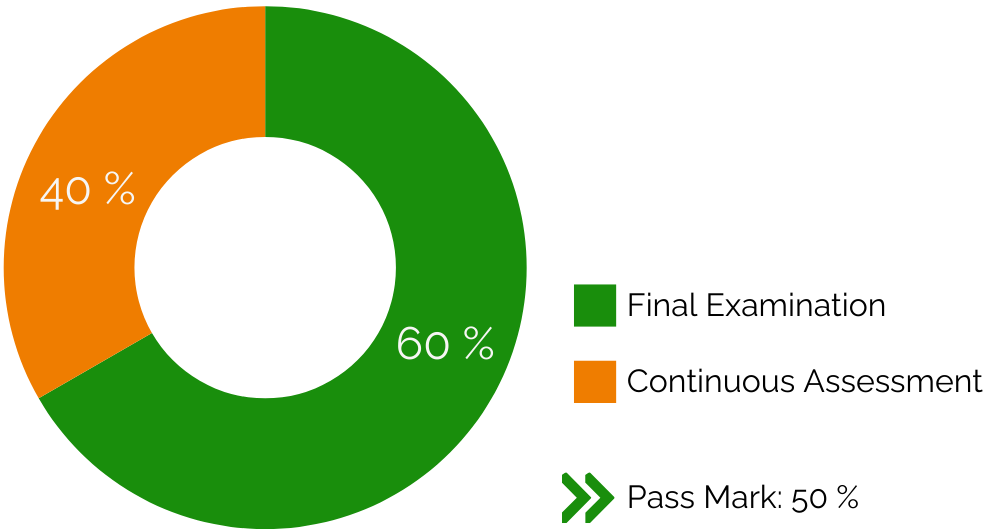

8. Student Assessment

The break down for assessment is as follows:

9. Attendance

The candidate must have an attendance of minimum 85% to be eligible for the final examinations.

10. Progression Requirements

Failures

Trainees failing in 50 % or more modules at any level shall be allowed to proceed to the next level. Trainees failing in less than half of the modules shall only be given two chances to re-sit examinations, after which they shall be removed from the programme if they fail to clear the arrears.

Referrals

Trainees failing in less than 50% of the modules at any level shall be allowed to continue with the programme, but shall have to re-sit the examinations within at the next examinations session and clear the arrears before sitting for final summative examinations.

11. Certification

A Diploma in Local Government Finance shall be awarded to the successful candidate by Technical Education, Vocational and Entrepreneurship Training Authority (TEVETA).